A Complete Guide to Understanding Coverage, Cost, and Value

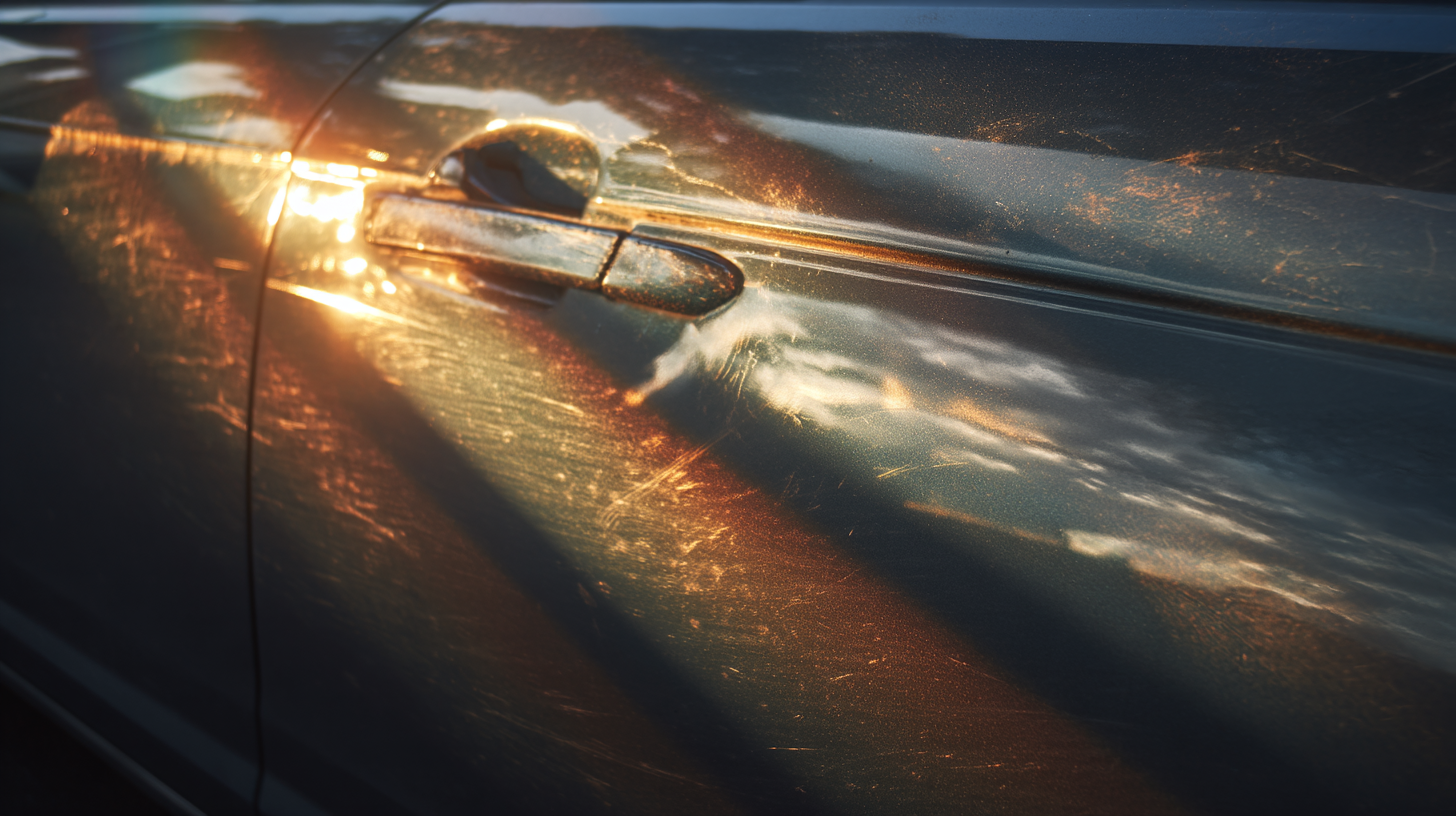

Many drivers ask the same question at some point: Do I need collision insurance? It’s a smart question because car insurance can be complicated, and not every type of coverage makes sense for every vehicle or driver. Collision insurance is one of the most important parts of a car insurance policy, but it’s also one of the most misunderstood. Whether you have a new car, an older car, or you’ve already paid off your vehicle outright, understanding collision coverage can help you make the right decision for your financial situation and peace of mind.

What Is Collision Insurance and How Does It Work?

Collision insurance pays to repair or replace your own vehicle after a car accident or collision with another car, object, or structure. It doesn’t matter who caused the crash. Collision insurance pays for your vehicle’s repairs or for the actual cash value of your car if it’s a total loss. This type of coverage can be valuable if your repair costs are high or if you can’t afford to pay out of pocket after an accident.

Unlike liability insurance, which pays for property damage or bodily injury you cause to someone else, collision coverage protects your own vehicle. When combined with comprehensive coverage, you have what most car insurance companies call full coverage car insurance. Comprehensive and collision together protect against both crash-related and non-crash-related damage, giving you the widest protection possible under a standard auto insurance policy.

Is Collision Insurance Required by Law?

Most states do not require drivers to carry collision insurance, but lenders require it if your vehicle is financed or leased. If you owe money on your car, your lender wants to protect their investment until the loan is paid off. Once you own the vehicle outright, you can decide whether to keep or drop collision insurance. Even though car insurance companies do not make it mandatory, many drivers choose to keep collision coverage because it offers peace of mind.

If your lender requires coverage, they may also require comprehensive insurance, which protects against things like theft, vandalism, or natural disasters. In these cases, dropping collision or comprehensive coverage could violate your financing agreement. Always confirm your insurance policy details with your insurance company or insurance agent before making changes.

When Collision Coverage Makes Sense

You Still Owe Money on Your Vehicle

If your car is financed or leased, keeping collision coverage is not optional. Most lenders require you to carry both collision and comprehensive coverage until your loan is fully paid. Dropping collision too soon could leave you responsible for the full repair costs or replacement value if your car is totaled.

Your Vehicle Has a High Value

Drivers with new cars, luxury vehicles, or models with advanced safety technology should strongly consider keeping collision coverage. Modern vehicles often come with complex sensors, cameras, and paint systems that make repairs more expensive. If your car’s actual cash value is still significant, the collision insurance cost is likely worth the protection.

You Can’t Afford to Repair or Replace Your Car

If a crash would create financial hardship, collision insurance can save you from paying thousands out of pocket. For many people, collision coverage pays for itself after just one accident. It provides the ability to repair or replace your car without draining savings or taking on new debt.

You Want Peace of Mind

Even safe drivers can be involved in a car accident caused by someone else. Having collision coverage helps you stay protected regardless of who’s at fault. It’s particularly useful if you live in an area with heavy traffic, narrow streets, or crowded parking lots where minor collisions are common.

When You Might Not Need Collision Insurance

Your Car’s Value Is Low

If your vehicle’s value has dropped below a few thousand dollars, collision coverage may not be cost effective. Experts often recommend dropping collision when your annual premium equals more than 10 percent of your car’s actual cash value. For example, if your car is worth $4,000 and you pay $500 a year for collision, it may not make financial sense to keep it. This is often true for older cars and older vehicles with high mileage.

You Have a Strong Financial Cushion

If you have enough savings to repair or replace your car yourself, you can consider dropping collision insurance. Drivers who can comfortably pay out of pocket after an accident might prefer to take the financial risk in exchange for lower premiums.

Your Vehicle Is Fully Paid Off

Once you’ve paid off your car loan, you have more flexibility with your car insurance coverage types. Many people drop collision insurance when they own the car outright, especially if it’s an old car with low market value. However, even if you decide to drop collision, it’s smart to keep comprehensive coverage for protection against non-collision events such as hail, theft, or falling tree branches.

Collision vs Comprehensive: Knowing the Difference

Collision and comprehensive coverage are often bundled together, but they serve different purposes.

- Collision coverage: Covers your car when it hits another car, guardrail, fence, or object.

- Comprehensive coverage: Covers your car when it’s damaged by something other than a collision, such as weather, vandalism, theft, or hitting an animal.

Having both types gives you complete protection. This combination of comprehensive and collision insurance is sometimes referred to as comprehensive and collision or simply “full coverage.” Comprehensive insurance pays for damage caused by non-collision events, while collision coverage pays for crash-related damage. Together, they ensure your auto insurance policy covers nearly every situation.

Factors That Affect Collision Insurance Cost

Vehicle Type and Age

New cars cost more to insure because their repair costs and replacement values are higher. As a car ages, the collision insurance cost typically decreases. However, luxury models, electric vehicles, and cars with advanced safety systems may still have higher premiums because of the specialized parts and labor required to fix them.

Deductible Amounts

Your collision deductible is the amount you pay before your insurance company covers the rest. Choosing a higher deductible can lower your premium, but you’ll pay more out of pocket in the event of a total loss or repair claim. A lower deductible offers more coverage but increases your monthly cost. Finding the right balance between deductible amount and affordability is key to a good car insurance policy.

Driving Record and Location

Drivers with a clean record or a history as a safe driver often receive better value and lower deductible options from most insurers. Living in areas with high traffic or frequent car accidents may increase your rates.

Financial Situation and Credit Score

Insurance companies may consider your financial situation and good credit when calculating premiums. According to the National Association of Insurance Commissioners and Quadrant Information Services, drivers with strong credit and no claims history tend to enjoy average rates that are 10–15% lower than those with previous claims.

How to Decide If Collision Insurance Is Worth It

Making the decision to keep or drop collision insurance comes down to balancing risk and cost. Here’s a simple way to evaluate it.

Step 1 – Check Your Vehicle’s Value

Start by checking your car’s actual cash value using Kelley Blue Book or Edmunds. If your car is worth more than a few thousand dollars, keeping collision likely makes sense.

Step 2 – Review Your Premium and Deductible Amount

Look at your annual premium and deductible amount. If the yearly cost of collision coverage is high compared to your car’s value, it might not be worth keeping. However, if your deductible is low and your vehicle’s value is still strong, the protection may still offer better value.

Step 3 – Consider Your Finances

If paying for repairs or replacement would hurt your financial situation, it’s smart to maintain collision coverage. Collision insurance cover helps you avoid sudden expenses that could set you back financially.

Step 4 – Review Your Car’s Condition and Age

If your car’s condition is poor or your vehicle is more than 10 years old, you might benefit from dropping collision coverage. For older cars, the payout after a total loss may be minimal compared to what you’re paying each year in premiums.

Step 5 – Talk to Your Insurance Agent

Before changing your coverage, speak with your insurance agent or insurance company. They can help you evaluate your insurance policy, review deductible amounts, and make sure you understand what’s covered and what’s not.

The Role of Comprehensive Insurance

While you might drop collision, keeping comprehensive insurance is often a smart move. It protects you from damage caused by storms, flooding, theft, vandalism, or even hitting a deer. Since comprehensive insurance usually costs less than collision, it provides affordable protection for older vehicles. Comprehensive coverage is especially useful in areas with frequent severe weather or high theft rates.

Common Questions About Collision and Comprehensive Coverage

What’s the Difference Between Collision and Full Coverage Car Insurance?

Full coverage car insurance includes both collision coverage and comprehensive coverage, plus liability insurance. Collision protects your vehicle from accidents, while comprehensive covers non-collision damage.

Does Collision Insurance Cover Hit-and-Run Damage?

If you’re involved in a hit-and-run car accident, collision coverage can pay for your vehicle repairs. However, it depends on how your insurer classifies the event.

Can I Drop Collision Insurance on an Old Car?

Yes, many people drop collision or skip collision coverage when their car’s value is low. If you can afford to repair or replace your car yourself, dropping collision is often a reasonable choice.

How Do Deductible Amounts Affect My Premium?

Choosing a higher deductible lowers your premium but increases what you pay out of pocket after an accident. Choosing a lower deductible does the opposite. Your insurance company or insurance agent can help you decide which option fits your needs.

Does Collision Coverage Include a Rental Car?

If your car is being repaired after an accident, collision insurance might help cover a rental car depending on your car insurance policy. Ask your insurer whether rental reimbursement is included.

What If I’m a Safe Driver With No Claims?

A safe driver with no recent accidents can often qualify for lower premiums. Some car insurance companies offer discounts for a clean record, good credit, or enrolling in a driver safety program.

Making the Final Decision

Whether you decide to keep or drop collision insurance, the goal is to balance protection with affordability. For many drivers, collision coverage remains an essential part of auto insurance, especially for newer vehicles with high repair costs. For older vehicles, the coverage may not be worth the expense.

Take time to evaluate your financial situation, your car’s actual cash value, and how much risk you’re comfortable taking on. Review your insurance policy at least once a year and adjust as needed.

If you’re unsure what’s best, speak with your insurance company or a trusted insurance agent who understands your local market and can explain your options clearly.

Final Thoughts

The question “Do I need collision insurance?” doesn’t have a one-size-fits-all answer. It depends on your car’s value, your financial situation, and how much peace of mind you want. Collision insurance is designed to help drivers repair or replace their vehicles after an accident, offering security when it matters most.

If your car is new, valuable, or still financed, keeping collision coverage is a wise decision. If you drive an older car and can afford to cover repairs yourself, dropping collision might save you money. Either way, make the decision based on facts, not assumptions. Review your auto insurance policy, ask questions, and make sure your coverage reflects your needs.

Re-Lux Collision is here to help you understand how insurance works and to provide expert repair service if your car has been in an accident. Whether you’re filing a claim or comparing options, our team is committed to transparency, precision, and customer care. Get your free estimate today and drive with confidence knowing your vehicle is protected.